On 16 December 2022, the Corporate Sustainability Reporting Directive (CSRD) was published in the Official Journal of the EU. The CSRD replaces the Non-Financial Reporting Directive (NFRD) and extends reporting requirements with regard to people and the environment, responsible corporate governance and supply chain responsibility.

CSRD background

Globally, the focus on ESG (Environmental, Social, Governance) continues to expand. In this context, the EU has expressed its commitment to climate neutrality by 2050 in the European Green Deal. At the same time, the EU wants to promote future-proof economic growth that ensures stability, employment and sustainable investment. The above ambitions have led the EU to issue several directives and regulations. One example is the EU Taxonomy Regulation, which provides a classification system to indicate whether a financial product or investment is sustainable. The Sustainable Finance Disclosure Regulation (SFDR) also brings sustainability-related obligations, such as the requirement for asset managers to be transparent about their ESG policy or risk policy, as well as performance. The CSRD is also an important part of sustainability ambitions, by requiring companies to report on sustainability and having this reporting reviewed (to a greater or lesser extent) by an auditor. Above all, what the EU Taxonomy Regulation, the SFDR and the CSRD have in common is that they all promote behavioural change among undertakings, investors and other stakeholders and encourage undertakings to achieve higher scores for the extent to which activities or products are green or contribute to achieving sustainability ambitions. In many cases, undertakings have to indicate when a particular disclosure requirement can be met, if it cannot be met at the time when the CSRD comes into force.

Main changes

- Formulating long-term ESG goals and policies

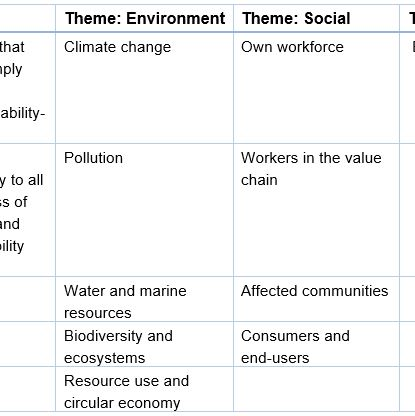

The CSRD requires companies to set clear ESG targets and disclose progress annually based on European Sustainability Reporting Standards (ESRS). The ESRS are being prepared by the European Financial Reporting Advisory Group (EFRAG) and are being issued in two stages. In November 2022, the first set of ESRS was proposed, which must be adopted by the European Commission by 30 June 2023. The second set of ESRS has to be adopted by 30 June 2024, setting out additional information that companies must disclose on specific sustainability issues and reporting areas, and information that companies must disclose that is specific to the sector in which they operate. The first set of draft ESRS includes 12 standards covering the following topics:

2. Extending the scope

The CSRD will cover about five times more companies than the current NFRD. The scope will be extended from large public-interest undertakings, i.e. listed companies, banks and insurance companies with >500 employees, to include the following categories:

- large undertakings, listed or unlisted (or undertakings exceeding at least two of the following values: a balance sheet total of €20 million, net turnover of €40 million, and an average number of 250 employees during the financial year);

- large non-EU undertakings with substantial activities in the EU market (a net annual turnover of €150 million in the EU) and which have at least one subsidiary or branch in the EU exceeding certain thresholds; and

- small and medium-sized undertakings with securities admitted to trading on an EU regulated market, excluding micro enterprises, small and non-complex credit institutions and captive insurance entities.

3. Clarifying the double materiality principle

The double materiality approach requires companies to report on the impact the company has on people and the environment on the one hand, and the impact of sustainability issues on their company, both positive (e.g. striving for a diverse and inclusive work environment) and negative (resource scarcity) on the other.

4. Due diligence on own operations and supply chain too

Undertakings must report not only on their own performance regarding ESG themes, but also on that of their clients and suppliers. The exact requirements will be detailed by EFRAG on a theme-by-theme basis. An exception may be invoked in the first three years for not being able to retrieve all value chain information.

5. Mandatory assurance for sustainability reporting

Sustainability information should be included in the management report and audited by an independent auditor. Initially, the CSRD provides for ‘limited’ assurance of the sustainability report by an auditor, which is more than was required under the NFRD. The requirement for ‘limited’ assurance is expected to gradually shift to a requirement for ‘reasonable’ assurance.

Phased entry into force

The requirements will take effect in phases, depending on the type of company:

- 1 January 2024 for companies already covered by the NFRD (reporting in 2025 annual report for financial year 2024);

- 1 January 2025 for non-NFRD undertakings (reporting in 2026 annual report for financial year 2025);

- 1 January 2026 for listed SMEs, small and non-complex credit institutions and captive insurance companies (reporting in 2027 annual report for financial year 2026, with SMEs being granted an extension until 2028);

- 1 January 2028 for the large non-EU undertakings mentioned earlier (reporting in 2029 annual report for financial year 2028).

Preparation: what steps to take now?

For many undertakings, reporting on sustainability information is new, especially to this extent. The management report will be considerably more voluminous. To actually be able to report in line with CSRD standards from FY2024 or 2025, first requires an understanding of issues such as the undertaking's own information processes, KPIs and data applications. But it also requires an understanding of closely related legislation such as the above EU Taxonomy Regulation, as well as knowledge of other guidance such as that of the Task Force on Climate Related Financial Disclosures (TCFD) and initiatives such as the Corporate Sustainability Due Diligence Directive (CSDDD). In addition, other future legislation on sustainability is also relevant, such as the proposal for the Dutch private member’s bill Responsible and Sustainable International Business Conduct Act (Wet VDIO) and the updated Corporate Governance Code (see our newsletter of 20 December 2022). Similarly, any undertaking preparing for the CSRD should consider how its governance can be properly structured to meet the broad disclosure requirements. For many undertakings, next year will therefore be dominated by further preparation for the CSRD.

We will be happy to engage with you to discuss your preparedness for the CSRD and related legislation.